Offering some rare insight into the scale of HBM memory sales – and on its growth in the face of unprecedented demand from AI accelerator vendors – the company recently disclosed that it expects HBM sales to make up "a double-digit percentage of its DRAM chip sales" this year. Which if it comes to pass, would represent a significant jump in sales for the high-bandwidth, high-priced memory.

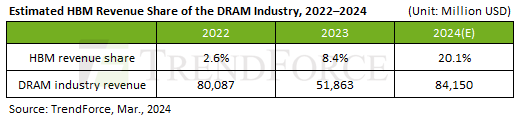

As first reported by Reuters, SK hynix CEO Kwak Noh-Jung has commented that he expects HBM sales will constitute a double-digit percentage of its DRAM chip sales in 2024. This prediction corroborate with estimates from TrendForce, who believe that, industry-wide, HBM will account for 20.1% of DRAM revenue in 2024, more than doubling HBM's 8.4% revenue share in 2023.

And while SK hynix does not break down its DRAM revenue by memory type on a regular basis, a bit of extrapolation indicates that they're on track to take in billions in HBM revenue for 2024 – having likely already crossed the billion dollar mark itself in 2023. Last year, SK hynix's DRAM revenue $15.941 billion, according to Statista and TrendForce. So SK hynix only needs 12.5% of its 2024 revenues to come from HBM (assuming flat or positive revenue overall) in order to pass 2 billion in HBM sales. And even this is a low-ball estimate.

Overall, SK hynix currently commands about 50% of HBM market, having largely split the market with Samsung over the last couple of years. Given that share, and that DRAM industry revenue is expected to increase to $84.150 billion in 2024, SK hynix could earn as much as $8.45 billion on HBM in 2024 if TrendForce's estimates prove accurate.

It should be noted that with demand for AI servers at record levels, all three leading makers of DRAM are poised to increase their HBM production capacity this year. Most notable here is a nearly-absent Micron, who was the first vendor to start shipping HBM3E memory to NVIDIA earlier this year. So SK hynix's near-majority of the HBM market may falter some this year, though with a growing pie they'll have little reason to complain. Ultimately, if sales of HBM reach $16.9 billion as projected, then all memory makers will be enjoying significant HBM revenue growth in the coming months.

Sources: Reuters, TrendForce